All Categories

Featured

:max_bytes(150000):strip_icc()/pros-cons-indexed-universal-life-insurance.asp_v1-e119226901bc464593a496c003551ea0.png)

[/image][=video]

[/video]

Withdrawals from the money value of an IUL are generally tax-free up to the amount of premiums paid. Any kind of withdrawals above this amount might be subject to taxes depending on plan framework.

Withdrawals from a Roth 401(k) are tax-free if the account has been open for a minimum of 5 years and the person mores than 59. Properties withdrawn from a conventional or Roth 401(k) before age 59 might sustain a 10% charge. Not specifically The cases that IULs can be your own bank are an oversimplification and can be deceiving for numerous reasons.

You may be subject to upgrading associated health inquiries that can impact your recurring costs. With a 401(k), the cash is always yours, consisting of vested company matching despite whether you quit contributing. Threat and Assurances: Most importantly, IUL plans, and the money worth, are not FDIC guaranteed like standard checking account.

While there is generally a flooring to stop losses, the development potential is covered (meaning you might not fully gain from market upswings). The majority of experts will agree that these are not equivalent products. If you desire death benefits for your survivor and are worried your retirement financial savings will not suffice, then you might intend to think about an IUL or various other life insurance policy item.

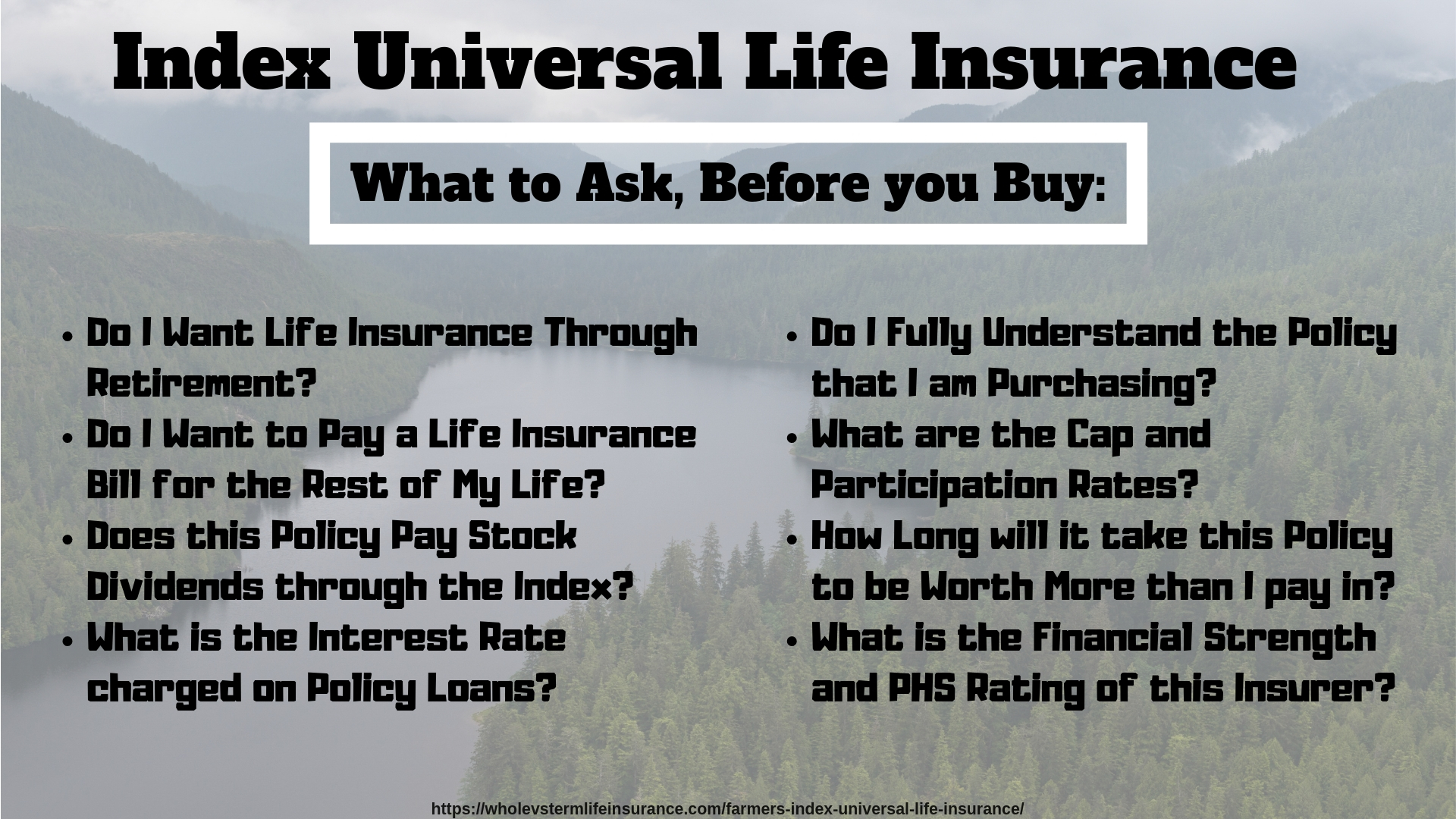

Certain, the IUL can offer access to a money account, but again this is not the main function of the product. Whether you desire or need an IUL is an extremely specific question and relies on your primary financial purpose and goals. Nevertheless, listed below we will certainly try to cover benefits and constraints for an IUL and a 401(k), so you can additionally define these items and make an extra enlightened decision regarding the ideal means to handle retirement and taking care of your loved ones after death.

Indexed Universal Life Insurance 2025

Loan Costs: Fundings versus the policy build up rate of interest and, otherwise paid back, decrease the survivor benefit that is paid to the recipient. Market Engagement Limitations: For most plans, investment growth is connected to a stock market index, but gains are generally topped, limiting upside possible - what is an iul investment. Sales Practices: These policies are frequently sold by insurance coverage representatives that might highlight advantages without totally explaining expenses and risks

While some social networks experts suggest an IUL is a replacement product for a 401(k), it is not. These are different items with different purposes, functions, and prices. Indexed Universal Life (IUL) is a sort of permanent life insurance policy plan that additionally uses a cash money value part. The money value can be used for several functions consisting of retirement savings, additional earnings, and other monetary requirements.

Latest Posts

Transamerica Iul

Nationwide Indexed Universal Life Insurance

Iul Unleashed